QuickBooks integration saves hours

TL;DR: Loop now integrates with QuickBooks streamlining your crypto payments process. Simply create an invoice in Quickbooks and include a Loop payment link. That’s it. Loop will take care of the rest from marking the invoice as paid when funds are received (including the transaction hash) to ensuring you get paid the full amount on the right chain in the right token.

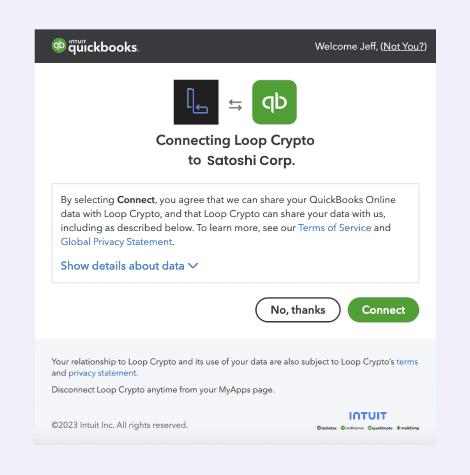

Best of all, getting set up is as simple as clicking a button.

Loop + QuickBooks

A critical challenge most businesses face with crypto payments is that it’s extremely manual, and you might not even collect the full or correct amount due to price volatility, on the right chain, in tokens you want. Getting paid via Loop is the simple key to fixing all of this. This is especially important for small teams where every hour they spend tracking down payments is an hour they aren’t spending focusing on their core product.

With Loop’s new QuickBooks integration, you can continue to use (or start using!) QuickBooks as your invoicing solution while enabling Loop as a payment option for those customers who want to pay in crypto. As soon as a payment is made via Loop, the QuickBooks invoice is immediately updated as “Paid” and any automations you have built off of closing invoices can now be automatically triggered.

Why we built this?

When getting paid in crypto, one of the biggest challenges today is matching invoices to on-chain payments. QuickBooks is one of the most popular accounting platforms, especially among startups and small businesses. It has a vast feature set. Among those features is the ability to create products and generate invoices to bill customers for those products.

While there are certainly other invoicing tools on the market, the beauty of using QuickBooks for invoicing is that it automatically syncs with your accounting setup. For example, a customer makes a payment, the invoice is marked as paid, the cash account is debited, and accounts receivable is credited. All of this happens automatically.

Historically, the challenge with crypto payments has been recognizing when you get paid and then trying to figure out which invoice to apply that payment to. For most companies, this has been done manually and takes hours. They will ask a customer to send funds to a specific wallet address and then send over the transaction hash as confirmation once they send the funds. With that transaction hash, the bookkeeper, accountant, or business owner then needs to match the crypto payment to an invoice, mark it as paid, and then update the requisite accounts in their accounting setup. This is inconvenient when you’re dealing with 2 or 3 customers, but it quickly becomes untenable when you start to scale. We’ve heard over and over from our clients that they spend hours chasing down customers for transaction hashes and then trying to apply the hash against the right invoice.

With our QuickBooks integration, we set out to fix this. 😁

How does it work?

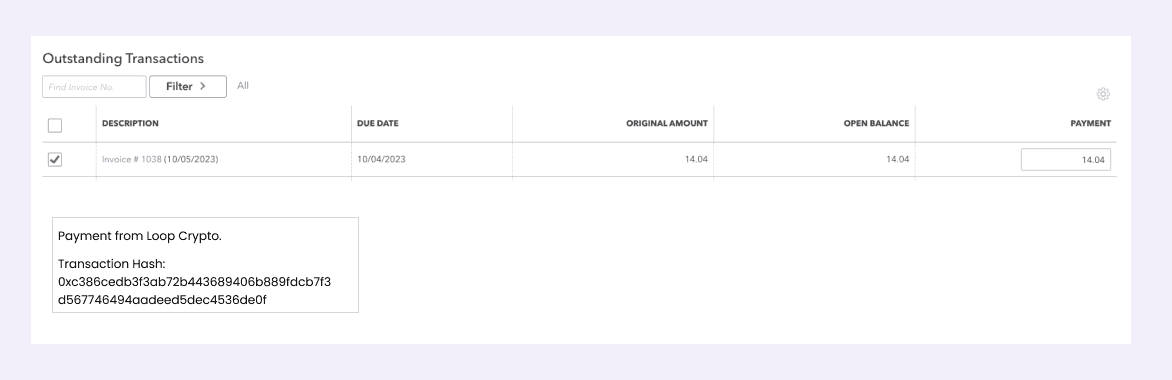

By syncing Loop and QuickBooks, we’re able to solve this payment-to-invoice matching problem. If you’re using QuickBooks to invoice your customers, very little changes. You create an invoice as usual in QuickBooks. The only difference is that you will paste in a Loop checkout URL with the invoice number appended to the end of the URL. When the customer receives the invoice, she simply clicks on the Loop checkout link within the invoice and authorizes the payment. As soon as the payment processes on chain, the QuickBooks invoice will be marked as paid and the transaction hash will be synced with the QuickBooks invoice and stored in the memo field. As simple as that!

Note: If you want to dig into more details, you can always checkout out our documentation.

With this initial release of the Alpha version of the integration, the accounts receivable account in QuickBooks will be updated showing that receivables has been credited. In the coming weeks, we will be including additional functionality that will automatically update the “deposit to” account as well. This means that if you have specific accounts designated to track crypto or stablecoin balances these can be automatically debited as well.

What are the benefits?

One source of truth

When we launched our Stripe integration back in May 2023, one of the biggest motivators was the consistent feedback we received that companies want to manage all of their customers in one system. They don’t want to toggle back and forth between systems depending on a customer's payment method. Fiat and crypto payments need to flow to one database or source of truth.

When it came to invoice management, we heard the same feedback. Teams want one system where they can manage all of their invoices - see which ones are paid and which are outstanding. With this latest integration, we allow for just that. QuickBooks remains the source of truth for all invoices generated, and then regardless of payment method, the invoice is closed out when payment is received.

Discount codes and more

The QuickBooks invoicing interface allows for the creation of discounts on top of standard product amounts. For example, you can create a product in QuickBooks for $1,000 and then apply special discounts for individual invoices as you customize pricing for specific customers or promotions. Charging taxes is simple as well. QuickBooks will generate the tax rate and apply it to the invoice.

Loop ultimately charges the end customer the final calculated invoice amount. This means you can apply discounts and promotions in QuickBooks and the updated amount will be reflected in the Loop checkout URL.

Timing savings

As noted previously, Loop is bringing automation to a process that has historically been manual. We know of too many teams that are spending hours every month reconciling transaction hashes to figure out if they got paid and then close out their books. While we have plans to add more functionality that will automate even more accounting work, solving the crypto payment to invoice matching problem is a huge first step in saving teams hours every month.

How to get started?

Set up is as easy as clicking a button. If you’re not already using Loop, it only takes a few minutes for us to set up your account. From there, we simply generate a link for you to click and immediately connect your QuickBooks account to Loop.

Let’s start saving you time now. Schedule a call to get started.

___________________________________________________________________________________________________________________________________

About Loop

At Loop Crypto, we build infrastructure to unlock truly programmable money and create an open financial system. We enable crypto payments for 50+ of the top web3 companies, including Pinata, Neynar, Paragraph, Kaito, ETHGlobal, and ENS, supporting millions of dollars transacted and saving thousands of hours.

Whether the payment is one-time or recurring, Loop supports a broad range of payment use cases: subscriptions, one-time charges, recurring bill pay, loan repayments, and donations. Our integrations with Stripe, QuickBooks, and Xero make it easy to implement crypto payments within your existing operations.

If you’re ready to get started, book a call with our team to get started in minutes.

Stay in the Loop.