How Privy uses Loop + Stripe to grow its client base

TL;DR: Privy’s customers were looking to pay in crypto, but Privy only wanted to accept crypto if they had a solution that could scale as their business expands. In short, they wanted automation. With Loop’s Stripe integration, Loop plugged into the system Privy already built, unlocking crypto payments without them having to change a thing.

Introduction

Privy is an early-stage web3 startup founded in 2021 by Asta Li and Henri Stern. Their combination of experiences both in and outside of web3 led them to quickly hone in on the challenge of onboarding new users to web3. In short, the experience was too difficult, and someone needed to make it easier. Thus, Privy was born with the goal of providing developers with a single library to onboard all their users to web3.

Recently, Privy began working with Loop to enable crypto payments for its clients. In this article, we dig into Privy’s journey to enabling crypto payments and the key values that Loop provides them with features like autopay and a Stripe integration. Let’s dive in!

Privy’s customer base

In the last several months, Privy has seen significant success landing a number of big-name clients, including friend.tech and Blackbird. As their client base grew, they were increasingly fielding requests to enable payment in crypto for their services. As a Software-as-a-Service (SaaS) business, Privy has a tiered subscription pricing model. They charge their clients on a monthly basis depending on the number of active users the client has. Their clients are primarily web3 developers who are building the next wave of consumer applications interacting with on-chain data.

With a lean team that provides white-glove service to their clients. Having a self-serve option on their website was not critical early on, but they needed the ability to quickly send a payment link to a new client when it came time to close the deal and get paid. As Privy’s business lead Max Segall describes, they wanted to offer crypto payments to meet the desires of the web3 teams they were looking to onboard:

“Paying with crypto is something that customers are asking us for. We’ve onboarded several companies that had a strong preference to do so versus fiat payments. I expect that number to grow both as a percent of our total base and obviously in absolute terms.”

Privy’s customers generate revenue and raise money in crypto. Therefore, they wanted to spend their assets that were already on-chain. It can be extremely difficult and expensive to off-ramp to pay for products and services in fiat. Often, it is not even possible if the customer is based in a country where they do not have access to dollars. According to Max, “...using a solution like Loop is much easier than needing to off-ramp funds every month.”

In addition to the option to pay in crypto, these clients also wanted automation. Many were using multi-sigs for payment. Coordinating signers every time a monthly bill came due was a major problem as one team member usually ended up chasing signers for several hours or even days.

Privy implements Loop

With this demand for automated crypto payments, Privy turned to Loop for three primary reasons…

(1) First, Loop solved the multi-sig coordination problem with its crypto autopay functionality. The owners of the multi-sig would only need to coordinate once to provide an authorization for a recurring monthly payment that could then be used to pay their Privy bill month after month.

Not only did autopay lower the operational burden of their customers, but it also provided major value to Privy by ensuring they were paid on time. Across all clients on the Loop platform, approximately 90% of recurring transactions scheduled with Loop are paid within 24 hours of their due date and 76% are paid within 1 hour of being due. This is a vast improvement compared to manually sending funds to a wallet address or using a one-time checkout application like Coinbase Commerce where monthly churn can be 2x that of fiat payments.

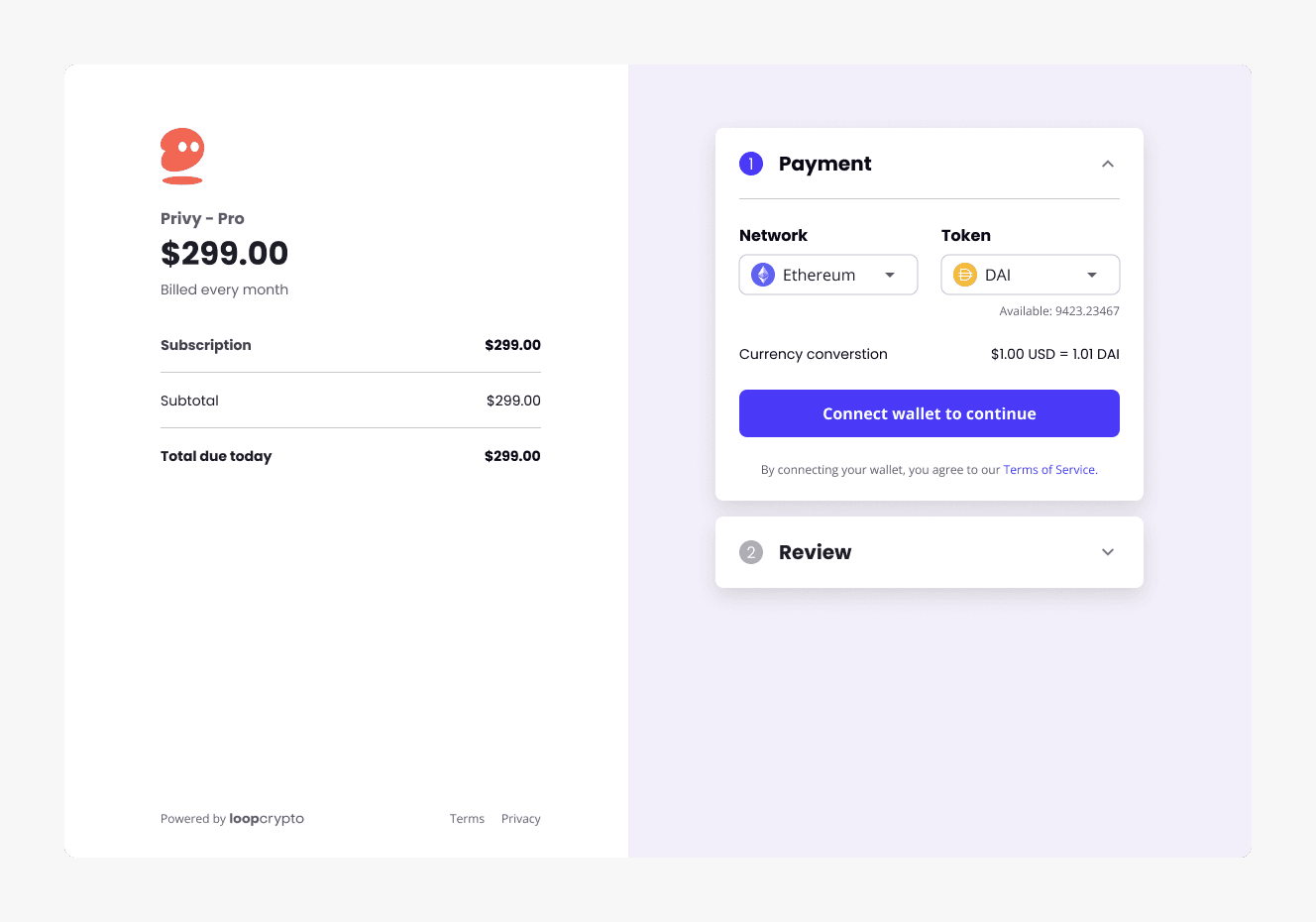

(2) Second, Loop integrated seamlessly with Stripe. Loop is web3 payments infrastructure and can plug into any front-end or can be used with our own front-end components. With Stripe, as with other payments front-ends, Loop operates as the crypto payment rails.

Like many web3 businesses, Privy accepts both fiat and crypto payments from its clients. It wanted a crypto payment solution that would allow them to continue using Stripe to manage all of their subscribers regardless of how they pay. They found the process flow of using Loop alongside Stripe super simple. They send a payment link to a client and immediately see the client details and transaction data synced to Stripe as soon as the client enables crypto autopay via Loop.

(3) In addition to the ease of the Stripe integration, the third reason was Loop’s ability to capture on-chain data and make payment reconciliation simple. While some early-stage startups begin by instructing customers to send funds directly to a wallet address, this is something Privy wanted to avoid from the start. They knew that approach would create a major headache down the road when it came time to close the accounting books and reconcile all of their on-chain transactions. With Loop, transaction hashes and payment metadata are automatically captured and easily exported via CSV or integrated with a subledger solution. As a lean startup team focused on scaling, this ensured no time was wasted on manual data reconciliation.

Conclusion

As we continue to see teams doubling down to build through the bear and focus on true use cases of web3, we’re excited to see what’s on the horizon for Privy. The team has built critical onboarding infrastructure that addresses head-on the UX challenges in web3. As we share a similar goal of bringing simplicity and security to web3, we’re rooting for Privy as they enter their next phase of growth with crypto payments enabled for their customers!

To learn more about Privy and how they make it simple to onboard users to web3, check out their website.

If you’re focused on growing revenue among a crypto-native client base, let’s talk. Loop can help you close deals and automate your payment operations. We’ll have you onboarded in minutes during a quick onboarding call.

___________________________________________________________________________________________________________________________________

About Loop

At Loop Crypto, we build infrastructure to unlock truly programmable money and create an open financial system. We enable crypto payments for 50+ of the top web3 companies, including Pinata, Neynar, Paragraph, Kaito, ETHGlobal, and ENS, supporting millions of dollars transacted and saving thousands of hours.

Whether the payment is one-time or recurring, Loop supports a broad range of payment use cases: subscriptions, one-time charges, recurring bill pay, loan repayments, and donations. Our integrations with Stripe, QuickBooks, and Xero make it easy to implement crypto payments within your existing operations.

If you’re ready to get started, book a call with our team to get started in minutes.

Stay in the Loop.